Chartered Institute of Management Accountants

Reed Business School are a premium approved CIMA Registered Tuition Provider, we have vast experience in getting students qualified since 1972. Our founder, Sir Alec Reed, is part of the world’s largest professional body of management accountants.

“The CIMA (Chartered Institute of Management Accounting) Professional Qualification is now called the CGMA (Chartered Global Management Accountant) Professional Qualification. Although the name has changed, there have been no changes to the syllabus, CIMA membership.”

Please go to their website for more information AICPA & CIMA | AICPA & CIMA (aicpa-cima.com)

Thinking about studying CIMA?

Why choose CIMA?

Management accountants are highly sought after, skilled professionals who combine business management with financial and analytical expertise. Studying CIMA demonstrates to employers worldwide that you’re gaining the knowledge and skills they need to drive business success. By studying CIMA, you will develop the critical knowledge and skills that employers are looking for and be ready to work in any business – large or small, public or private, all around the world.

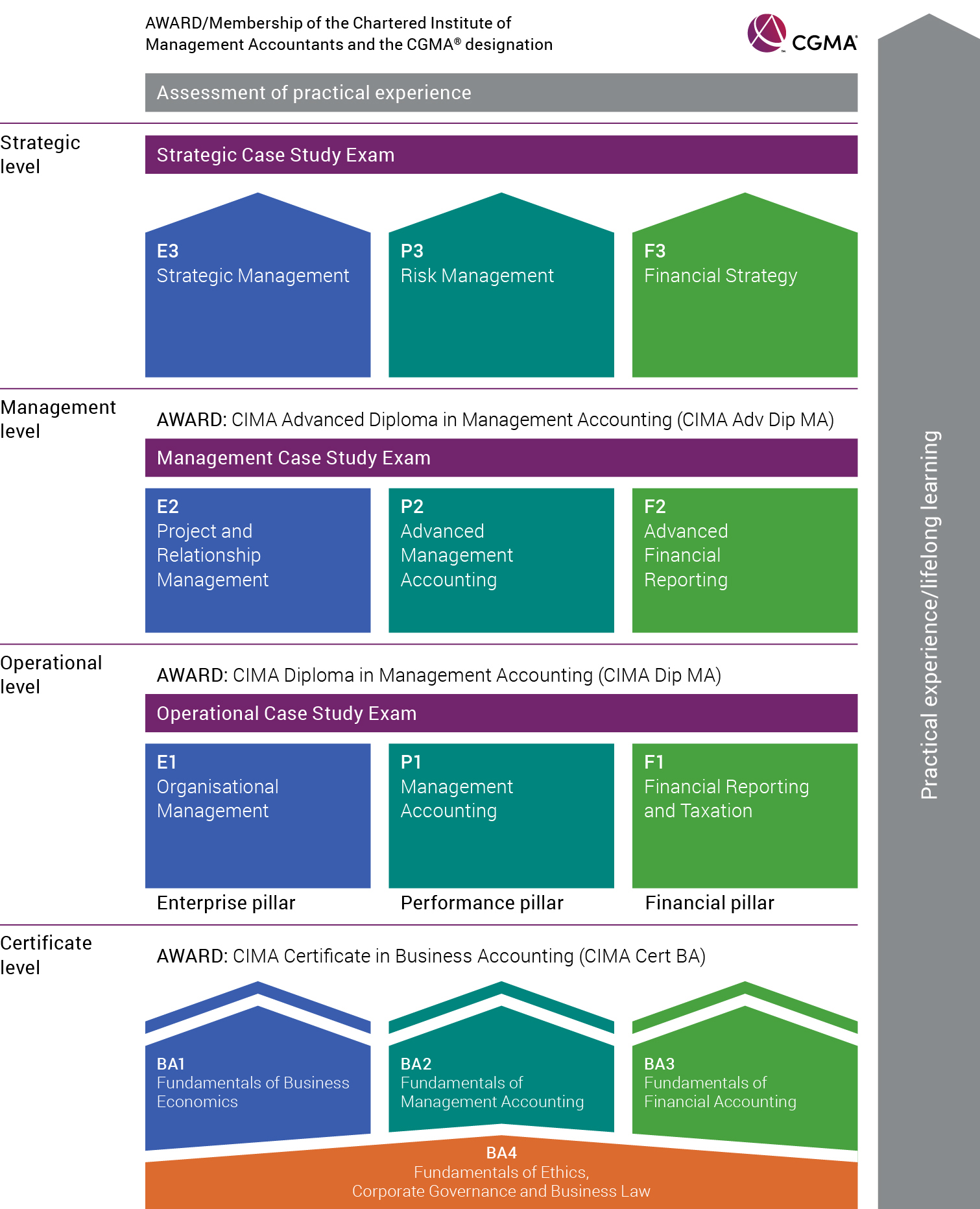

CIMA Qualification

CIMA provides the fundamental knowledge you need to build a successful career in business or finance, and helps you develop the critical skills that employers are looking for. There are two stages to the qualification:

- CIMA Certificate in Business Accounting

- CIMA Professional qualification

Requirements

There are no entry requirements for the CIMA Certificate in Business Accounting so you can start studying right now, no degree necessary. You will need a good understanding of both English and Maths, and a passion to succeed in business.

You will need to register with CIMA before you commence your studies. Please visit the CIMA website to find out more.

If you have any previous accounting experience you might be eligible for exemptions from subjects at this level or be eligible for full exemptions from this level and be able to move directly to the Professional level, find out more.

Supported by a quality training provider

Reed Business School is a well-established CIMA tuition provider with a long history of delivering excellent results. We structure each level of the qualification in accordance with our winning formula (based on over 50 years in the business), while giving you the flexibility to complete modules at your own pace.

Flexibility to choose your own path

Reed Business School offer hybrid training, with classroom-based tuition or remote live-online classes. These run in conjunction with each other allowing for greater flexibility in learning. This hybrid approach enables both classroom and remote live-online students to hear and interact with one another and verbally contribute to the whole class.

Apprenticeships

At the present time we do not offer CIMA through the apprenticeship scheme.

Start your journey here

The CIMA Certificate in Business Accounting (Cert BA) will help students with little or no accounting experience unleash their true business potential. Teaching core business and finance skills beyond simple financial accounting, Cert BA syllabus is the perfect stepping stone towards a career in business and finance. The Cert BA is a qualification in it’s own right and also forms a formal entry route into the CIMA Professional Qualification.

Better skills. Better business.

The CIMA Certificate in Business Accounting elevates people and businesses to success by developing skills and unlocking talent.

Overview

Exams: 4 Objective Tests

Time to complete: 12-18 months

Designation on completion: CIMA Cert BA

BA1 Fundamentals of Business Economics

The Aim

BA1 focuses on the economic and operating context of business and how the factors of competition, the behaviour of financial markets and government economic policy can influence an organisation. It also deals with the information available to assist management in evaluating and forecasting the behaviour of consumers, markets and the economy in general. Students will gain an understanding of the areas of economic activity relevant to an organisation’s decisions and, within this context, the numerical techniques to support such decisions.

Syllabus structure

The syllabus comprises the following topics and weightings:

- Macroeconomic and Institutional Context of Business (25%)

- Microeconomics and Organisational Context of Business (30%)

- Informational Context of Business (20%)

- Financial Context of Business (25%)

BA2 Fundamentals of Management Accounting

The Aim

BA2 teaches students fundamental knowledge and techniques that underpin management accounting. It identifies the position of the management accountant within organisations and the role of CIMA. The subject portrays the role of management accounting in the contexts of commercial and public sector bodies and its wider role in society.

Syllabus structure

The syllabus comprises the following topics and weightings:

- The Context of Management Accounting (10%)

- Costing (25%)

- Planning and Control (30%)

- Decision Making (35%)

BA3 Fundamentals of Financial Accounting

The Aim

In BA3 students will obtain a practical understanding of financial accounting and the process behind the preparation of financial statements for single entities. These statements are prepared within a conceptual and regulatory framework requiring an understanding of the role of legislation and of accounting standards. The need to understand and apply necessary controls for accounting systems, and the nature of errors is also covered. There is an introduction to measuring financial performance with the calculation of basic ratios.

Syllabus structure

The syllabus comprises the following topics and weightings:

- Accounting Principles, Concepts and Regulations (10%)

- Recording Accounting Transactions (50%)

- Preparation of Accounts for Single Entities (30%)

- Analysis of Financial Statements (10%)

BA4 Fundamentals of Ethics, Corporate Governance and Business Law

The Aim

In BA4 students will gain an understanding of the professional standards to be demonstrated for the benefit of all stakeholders. With this in mind, the place of ethics and ethical conflict is an essential underpinning for commercial activity. It includes the role of corporate governance, corporate social responsibility and audit; and their increasing impact in the management of organisations. Wherever business is conducted the legal and administrative framework underpins commercial activity. With this in mind the areas of contract law, employment law, administration and management of companies is considered.

Syllabus structure

The syllabus comprises the following topics and weightings:

- Business Ethics and Ethical Conflict (30%)

- Corporate Governance, Controls and Corporate Social Responsibility (45%)

- General Principles of the Legal System, Contract and Employment Law (15%)

- Company Administration (10%)

Driving business success

In an increasingly digital world it is imperative that finance professionals not only possess sound technical accounting and finance skills, but can also understand how digitalization and rapid changes in technology are creating challenges, and opportunities, for organisations. The updated syllabus includes how the digital world affects finance; this can be seen through the introduction of digital costing and digital strategy. Topics such as cybersecurity and business models have been have also been incorporated. Existing areas, such as integrated reporting, have been expanded to reflect their growing prominence.

Bridging the skills gap

Producing competent and confident management accounting professionals who can guide and lead their organisations to sustainable success.

Overview

Exams: 12 (nine Objective Tests and three Case Study exams)

Time to complete: 3-6 years

Designations: CIMA Dip MA (completion of Operational level), CIMA Adv Dip MA (completion of Management level), ACMA CGMA (Admittance to membership)

The full structure

The syllabus is split into three pillars and three levels, and comprises 12 exams: nine Objective Tests, and three Case Study exams.

What do you learn at Operational Level?

The Operational level focuses on short term decision making. You’ll be able to work with others in your organisation and use appropriate data and technology to translate medium term decisions into short term actionable plans. After successfully completing the level, you are awarded with the part-qualified designatory letters ‘CIMA Dip MA’ and are ready to embark upon your Management Level journey.

E1 Managing Finance in a digital world

What do you learn in E1?

- The central role that finance plays in an organisation, and how and why technologies used impact the finance function.

- How to use and examine data collected and processed by machines to create and preserve value for organisations.

- How the finance function is structured and shaped, and how it interacts with other parts of the organisation to achieve the objectives of the whole organisation.

P1 Management Accounting

What do you learn in P1?

- Why costing is done and what it is used for, including appropriate costing methods and techniques and where digital costing might be used.

- How budgets are prepared and implemented across the organisation, the impact these have, and how techniques are applied to ensure sound short-term decision making, against a backdrop of risk and uncertainty, by using appropriate risk management tools.

F1 Financial Reporting

What do you learn in F1?

- Who the regulators are, what they do and why and how regulations are applied.

- How to prepare basic financial statements using financial reporting standards.

- How to distinguish between types of taxes, calculate corporation taxes and issues affecting taxation.

- What tools are used to ensure that the organisation has enough cash to ensure its continuing operations.

Operational Level Case Study

Each level of the CIMA Professional Qualification culminates in a Case Study Examination, which integrates the knowledge, skills and techniques from across the three pillars into one synoptic capstone examination. At the Operational level, the role simulated is that of an Entry level finance professional and the capstone Case Study Examination provides a simulated context, which allows candidates to demonstrate that they have acquired the required knowledge, skills, techniques and mindset for that role.

Find out more by visiting the CIMA website.

What do you learn at Management Level?

The Management level focuses on translating long term decisions into medium term plans. You’ll be able to use data and relevant technology to manage organisational and individual performance, allocate resources to implement decisions; monitor and report implementation of decisions; as well as prepare and interpret financial statements to highlight business performance.

E2 Managing Performance

What do you learn in E2?

- The fundamentals of business models and how new business and operating models can be developed to improve the performance of organisations.

- How different styles of leadership can be used to improve the performance of individuals to achieve organisational goals and how to use performance management concepts and techniques to implement strategies effectively and efficiently.

- Use of project management concepts and techniques useful in implementing strategies.

P2 Advanced Management Accounting

What do you learn in P2?

- How to use cost management, quality and process management and value management to provide organisations with cost advantage.

- The criteria, process and techniques that are used to decide which projects to undertake, how to manage the performance of organisational units to ensure that they achieve their objectives.

- How to analyse risks and uncertainties that organisations face in the medium term, especially capital investment decision making, and managing those risks in the implementation of such decisions.

F2 Advanced Financial Reporting

What do you learn in F2?

- The sources and types of funds and how much they cost.

- The key financial reporting standards on which financial statements will be based and the application of those standards to prepare group accounts.

- The International Integrated Reporting Framework and its components and how to conduct analyses of financial statements and their limitations.

Management Level Case Study

Each level of the CIMA Professional Qualification culminates in a Case Study Examination, which integrates the knowledge, skills and techniques from across the three pillars into one synoptic capstone examination. At the Management level, the role simulated is that of a finance manager. The capstone Case Study Examination provides a simulated context allowing candidates to demonstrate that they have acquired the required knowledge, skills, techniques and the mindset required for that role.

Find out more by visiting the CIMA website.

What do you learn at the Strategic Level?

Strategic level is the third and final level of the CIMA Professional Qualification and consists of three subject areas and the Strategic level case study exam. The Strategic level focuses on long term strategic decision making. You will be able to support organisational leaders to craft strategy; evaluate and manage risks that might prevent organisations from successfully implementing strategy; value organisations; and source financial resources required to implement of strategy.

E3 Strategic Management

What do you learn in E3?

- The foundation of strategic management and an understanding of the dynamics of the organisational ecosystem and how it affects the strategy of the organisation.

- Strategic choice and how options are generated, linking them to the purpose, values and vision of the organisation and how the options are evaluated, chosen and integrated coherently to form the strategy of the organisation.

- How strategy is implemented, how implementation objectives are achieved and how change is managed.

- What are the technologies that underpin digital transformation and various elements of digital strategy.

P3 Risk Management

What do you learn in P3?

- How to identify, evaluate and manage enterprise risks.

- Where strategic risks emanate from, how to evaluate them and understand how oversight of these risks is critical to the governance of the organisation.

- How internal controls can be used effectively in the risk management process and how to identify, analyse, remedy and report strategic risks including cyber risks.

F3 Financial Strategy

What do you learn in F3?

- The different strategic financial objectives and policy options that are open to organisations.

- The types of funds available to organisations to finance the implementation of their strategies, including where and how they access these funds at the right time, in the right quantities and at the right cost.

- The sources of financial risk, how to evaluate and manage financial risk appropriately, and techniques in business valuation to assess whether a company has created and preserved value within the organisation.

- The valuation techniques to calculate value of organisations and conditions applicable for such calculations especially intangibles in the digital world and how to report intangible value and their drivers in integrated reporting.

Strategic level Case Study

Each level of the CIMA Professional Qualification culminates in a Case Study Examination, which integrates the knowledge, skills and techniques from across the three pillars into one synoptic capstone examination. At the Strategic level, the role simulated is that of the senior finance manager. The Case Study Examination provides a simulated context which allows learners to demonstrate that they have acquired the required knowledge, skills, techniques and mindset for that role.

Find out more by visiting the CIMA website.

Tuition delivery

Integrated

We run short comprehensive integrated courses scheduled over 2 or 3 phases depending upon the subject. The courses cover the core syllabus providing structure and clear objectives to enable students to build the necessary subject knowledge required to secure a pass. Question practice in class and via on-line practice exams form part of the course structure. Using Microsoft Teams as the tuition platform allows for flexibility in learning and access to the tutor outside of class for remote assistance and support.

Study Materials

The following course materials are provided within the course fee:

- Access to the Microsoft Teams platform

- Study text

- Revision question bank

- Revision cards

- Course notes

- Online access to practice mock exams

- Access to class recordings

Attending classes at the Manor

All Students

Students can attend on a residential or non-residential basis. Breakfast and lunch are provided to all students attending our courses at no extra charge.

Residential options

For students who wish to stay overnight, we offer highly competitive rates on a full board basis – providing you with a study-bedroom and all meals on site. You don’t have to spend any time travelling to and from courses and can focus solely on your learning. Our accommodation rates compare very favourably to hotel costs enabling us to maximise the value of your spend on professional development. The rooms come as either single or premium (these are en-suite rooms with a range of single, double or king-sized beds)

CBE Exam Centre

Sit your exams in the comfort of The Manor

Reed Business School is an CIMA exam centre, and the exams are scheduled after a short period after the course has finished to allow for consolidation of knowledge and question practice. Each course is scheduled in a modular approach so can be taken 1 at a time.

Booking your exams

Reed Business School is an CIMA exam centre for all levels of the qualification. Please note, a student must register with CIMA before they can sit an exam. If you are wish to book your exam with us, please complete our CIMA enrolment form. If you are not attending one of our courses and you wish to book your CIMA with us, please download our computer-based exam (CBE) dates, complete and return a booking form to us.

Please note places are subject to availability.

Course dates and relevant downloads

Please see below download options detailing current course timetables, fees, enrolment process and other relevant resources.

CIMA Summer 21 results analysis

(average course % by qualification level)

67%

pass rate

*Operational Level

100%

pass rate

*Management Level

N/A

pass rate

*Strategic Level

* <8 students, therefore may be statistically unreliable